Here’s How To Buy Bitcoin (And Store It Safely)

In 2020, Bitcoin was recognized as one of the best performing currencies of the previous decade, outperforming gold by over 190 times. Its sporadic rise over the years has made cryptocurrency a natural appeal for investors as its volatility presents an opportunity to make huge returns.

Many cryptocurrency beginners see crypto investing as difficult. However, it’s not. Like stocks, buying and storing Bitcoin is relatively easy. It requires an account in a decentralized exchange platform and safe storage (hard wallet) to hold your purchased token for heightened security.

Keep reading to learn how to buy Bitcoin and store it safely.

Table of Contents

How to Buy Cryptocurrency

Despite its popularity and massive adoption, many banking firms, as well as public and private financial organizations don’t allow Bitcoin or cryptocurrency purchases. So, for the most part, you can only make crypto transactions through private cryptocurrency equities that allow you to exchange your fiat for a corresponding amount of Bitcoin.

Usually, there are specific requirements before you can successfully become a verified member worthy of purchasing cryptocurrency. These federal requirements include personal documents showing necessary and verifiable information for you to complete the mandatory KYC (know your customer).

A secured internet connection and payment method are also needed to complete the buying process. Luckily, most cryptocurrency exchange platforms allow persons to use several methods of payment for ease.

Generally, there are two ways to buy cryptocurrency, i.e., through an exchange platform or Peer-to-Peer trading.

Exchange

There are over 100 cryptocurrency exchanges that offer a wide range of cryptocurrency tokens for sale. They perform similar functions as stockbrokers, offering cryptocurrency investment and management services. They also help you carry out your desired transaction and sometimes provide financial advice.

Choosing the best cryptocurrency exchange platform depends on several factors that can facilitate or mare your investing and trading experience. These factors include their service fees, the number of Fiat currencies they support, and their security strength.

As the day passes, new cryptocurrency exchange platforms come up. So, to simplify this process, some of the trusted crypto exchanges that tick the boxes of the factors above include Binance, Coinbase, KuCoin, Kraken, BlockFi, eToro, and Crypto.com.

Binance

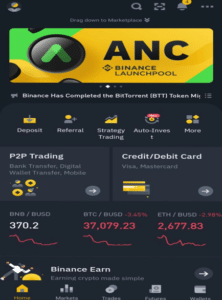

Founded in 2017 by ChaoPeng Zhao, Binance is a cryptocurrency exchange founded in China. It now has its operation spread across the world, reaching America, Malta, and even Singapore. It’s the largest crypto trading platform globally with the highest site visits and largest trading volume.

It allows its users to buy, sell, store, and trade cryptocurrency as it offers over 340 cryptocurrencies for sale. Binance has its software wallet called Trust wallet and is compatible with over 30 blockchains and supports over 150,000 digital or blockchain-based assets. It is mobile-friendly and is also compatible with both Androids and iOS smartphones. It gives users the liberty to store their cryptocurrencies safely.

It is also secured as it uses a 2FA implementation that protects the user account when activated. They charge $15 on wire deposits and a 5% fee on every debit card deposit; however, they do not charge for ACH deposits.

Opening an account is also easy as you can deposit and make trades without verifying your identity. However, KYC requirements indicate the need to submit official data and documents to access higher features.

Coinbase

Coinbase is an American exchange that operates remotely and has no structural headquarter building in any country. Brian Armstrong and Fred Ehrsam found Coinbase in 2012. Today, it is the largest trading exchange in the United States.

Users can trade over 100 cryptocurrencies, and the exchange is known for being one of the fastest processing times. They are also one of the few cryptocurrency exchanges regulated by the US government. Its fees are not user-friendly. However, they offer several reward programs to give back to their users. Their USD Coin reward programs reward Level 2 Coinbase holders, offering a 0.15% APY.

How to Buy Cryptocurrency on Binance

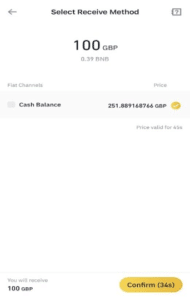

Binance allows various payment methods like debit and credit cards, Cash Balance, Wire, ACH, and P2P. As an exchange that supports KYC registration, verified users have full access to all the exchange features. So, there are limits to your deposit/withdrawal transactions as an unverified user. So, you should complete your identity verification by supplying the necessary personal information and documents before actively trading on the exchange.

Now, let us get into how you can buy cryptocurrencies on Binance.

1) Create an account on the platform either via mobile app or web interface.

2) Log in to your Binance account on your smartphone and get started by selling the ‘Buy with Cash’ or Credit/Debit Card’ button on the home screen.

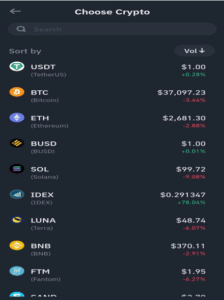

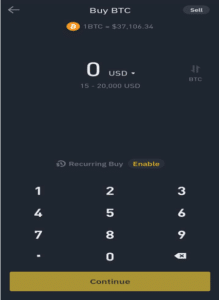

3) Choose the cryptocurrency you have in mind and key in the amount.

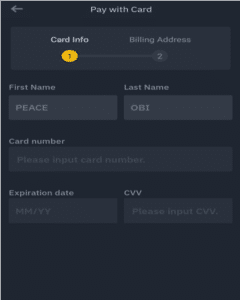

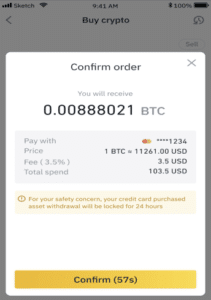

4) Accept the necessary terms and conditions and input your card.

5) Confirm your purchase.

6) Then, the tokens are deposited to your Binance Spot Wallet.

How to Sell Cryptocurrency on Binance

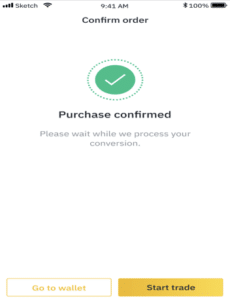

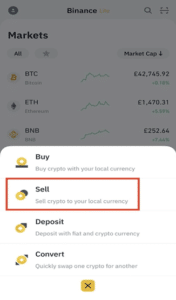

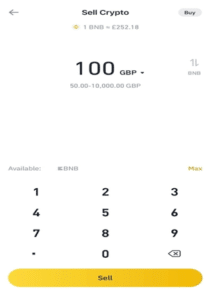

1) Log in to your Binance account and switch to the Binance Lite module. Tap on the trading button, then tap ‘Sell’.

2) Choose the cryptocurrency you want to sell and enter the ‘Sell’.

3) Binance allows users to collect their withdrawal from sales in several forms. However, these channels are limited depending on your country of origin. To check what categories your country falls into, refer to the app. For instance, if you’re selling crypto for pounds and euros, your Fiat currency will be credited to your cash balance for easy withdrawal.

Some countries like Nigeria offer P2P trading and can receive their Fiat currency direct to their bank account rather than their cash balance.

Peer to Peer/OTC Trading:

P2P or Peer to Peer trading is a transaction method to facilitate the transaction of cryptocurrency using local currencies directly. It allows users to exchange crypto assets for money or other crypto assets; this transaction occurs between two individuals or peers.

Unlike centralized exchanges, it usually doesn’t require verification and KYC automation before withdrawals. It allows for the trading of multiple cryptocurrencies like USDT, BTC, ETH, BUSD, etc.

P2P was born due to increased government regulation. Regulatory limitations to centralize cryptocurrency lent to the development of other payment systems.

How Does P2P Trading Occur?

Websites like www.localbitcoins.com are meeting points for buyers and sellers and ensure every transaction goes as it should. A user registers with an exchange like www.localbitcoins.com by supplying their name, email address, and password. The websites are different but sell offers from hundreds of merchants depending on your choice of cryptocurrency.

P2P on Binance

Launched in 2018, the success of P2P on Binance has sustained this trading method and has achieved a total transaction value of $7 billion. Here is how typical P2P trading occurs:

On the Binance platform is a P2P section that shows merchants and their offers. Each offer has distinct payment methods, price, and a minimum and maximum token they can sell. A buyer clicks on the offer of choice and meets up with the buyer saying how much cryptocurrency they want to buy. The seller contacts the buyer and accepts the offer by sending the preferred choice of payment.

The escrow policy guards the transaction between the buyer and seller. It ensures both parties fulfill their part of the deal and helps prevent fraud. Once the seller receives the money, he releases the cryptocurrency to the buyer.

How to Store Cryptocurrencies

The massive adoption of cryptocurrency has paved the room for hackers to steal crypto tokens and gain entry into people’s wallets. Hence, the need to know how to shore your cryptocurrency. Cryptocurrencies are stored in crypto wallets. These wallets exist in two forms, i.e., hot or cold wallets.

Hot Wallets

Hot wallets are online wallets provided to you by your exchange platforms when you buy a cryptocurrency and they run on phones, tablets, or PCs. They are susceptible to hacking and vulnerability because hot wallets generate private keys (which are 12 phrases that need to be arranged accordingly to gain entry to your wallet.) Although they are convenient ways to access your wallet, they possess a high-risk value.

They are further classified into:

● Mobile wallets, i.e., Coinomi.

● Desktop wallets, i.e., Exodus.

● Web wallets, i.e., Metamask.

Cold Wallets

Cold wallets are the safest crypto enclosure as they are not connected to the internet, making them safe from hackers. They are like hard drives and USBs that store a user’s address and private key offline. It allows users to view their portfolio without putting their private key at risk, safeguarding it from hackers.

A paper wallet is another form of cold wallet that you can generate off websites, and it simultaneously provides a public and private key that you can only access in that paper.

Conclusion

Diving into cryptocurrency to invest requires you to work through everything from registering for an account to buying, selling, and safeguarding the coins in a cryptocurrency wallet from hackers. It’s a continual process that requires patience and eventually pays off in the long run.

Do your homework. Learn how bitcoin works, what the mining process is, how the blockchain works, and your options for exchange sites.

Despite its $750 billion-plus market capitalization, Bitcoin’s still considered speculation as we do not know if cryptocurrency will be a widely accepted form of payment yet. It’s still early if you want to invest in Bitcoin, but it’s risky. It can’t hurt to get do your homework and learn more starting today. You have time.

Comment below. Do you own cryptocurrencies?

Disclosure: In The Game Investing and Theresa Bedford do not own any cryptocurrencies at this time and do not intend to buy or sell stocks within the next 10 days. Invest at your own risk. No investments are guaranteed.

Theresa is a personal finance blogger. She writes content for busy professional women to take control of their money and investments. She enjoys reading, traveling, cooking, and writing. Her work has been featured on GoBanking Rates, Your Money Geek, Savoteur, the Corporate Quitter, Thirty Eight Investing, and more.